AI Adoption in European Enterprises: The 2025 State of Play

Trends, Technologies, and Challenges in Enterprise AI.

Dr Umair Ali Khan, 16.7.2025

AI adoption has grown steadily among European companies over the past year. In 2024, an estimated 13.5% of EU companies (with 10+ employees) used at least one AI technology, up from about 8% the previous year.

Adoption is much higher among large companies, with roughly 41% of large EU enterprises (250+ employees) using AI in 2024, compared to 21% of medium-sized and 11% of small companies (Eurostat, 2025).

This reflects the greater resources and scale that big companies are devoting to AI. Nonetheless, even among Europe’s corporate giants, fewer than half have truly deployed AI so far, indicating considerable room for growth.

Adoption Gaps and Momentum Across Europe

Geographically, there are notable disparities within Europe. These gaps often correlate with differences in digital infrastructure and investment. Overall, however, every EU country saw AI use increase from 2024 to 2025, a positive sign of broad momentum.

If current trends continue, Europe could see a much larger share of companies using AI by 2020. The proportion of European companies consistently using AI has jumped from ~33% in 2023 to 42% in 2024, and Europe may reach near-universal adoption (~100% of businesses using some form of AI) by 2030 if growth persists (AWS, 2025).

In Europe, generative AI’s breakthrough in 2023–2025 has further accelerated adoption. According to a survey by Information Services Group (ISG) of Global 2000 companies in North America and Europe, over 65% of large companies were using generative AI by 2025, and this figure is expected to rise to 80% by 2026 (Glean, 2025).

In other words, two out of three big companies have now experimented with or implemented generative AI capabilities. Company leaders are increasingly convinced that AI is becoming essential for future competitiveness. In a recent European business leaders’ poll, 55% said they plan to boost AI investment in the next three years (Deloitte, 2024).

Despite this progress, adoption is still in an early phase for many. A “two-tier” pattern is emerging: digital-native startups tend to adopt AI deeply and quickly, while many established large enterprises use AI only superficially or in isolated projects. Approximately 68% of tech startups have adopted AI, but only 53% of large traditional enterprises have done so, and just 3% of those large companies have integrated AI into the core of their operations (AWS, 2025).

In practice, this means that while a majority of big companies might be piloting AI or using basic AI tools, few have truly transformed their business processes or strategies around AI so far. The next challenge for Europe is not only getting more companies to try AI, but also helping those already on board to scale up their AI initiatives from small experiments to company-wide impact.

Generative AI Breakthrough (2023-2025)

The emergence of generative AI has dramatically accelerated European adoption rates

Large companies using GenAI by 2025

65 %

Expected adoption by 2026

80 %

Leaders plan to boost AI investment

55 %

Key AI Technologies and Enterprise Use Cases

In 2025, European enterprises are adopting a wide range of AI technologies. Generative AI (especially LLMs) is being used for content creation, coding support, customer interaction, talking to company documents, automatic report writing, and incident reporting. Customer service departments have also integrated generative AI to handle routine inquiries.

Surveys show that about one-third of organizations globally are using generative AI regularly in at least one function, with marketing, customer service, and product development among the most common areas (McKinsey, 2024).

In Europe, interest is high, though many businesses are cautiously exploring its potential due to regulatory and accuracy concerns (Deloitte, 2024). Nonetheless, practical use cases such as automated report generation from multiple data sources and talking to the company’s internal documents are becoming more widespread.

Predictive analytics and machine learning are also being used in several applications. These systems analyze past and real-time data to predict trends, risks, and behaviors, such as customer churn, credit defaults, or equipment failures. European businesses are using predictive analytics in many applications, for instance analyzing physiological signals from smart devices, disease diagnosis, optimizing logistics, scheduling, or trend analysis.

While no single technology dominates enterprise AI use, machine learning for data analysis is one of the most common. About 4 to 5 percent of all EU enterprises used it in 2024, rising to over 20 percent among large companies (Eurostat, 2025), suggesting that predictive analytics has moved beyond pilot projects in many larger companies.

Automation, particularly AI-enhanced process automation, is another major area of adoption. AI-powered tools, such as robotic process automation (RPA), chatbots, and decision systems, are being utilized to automate repetitive tasks. Enterprises are automating workflows such as invoice processing, employee onboarding, and customer service routing.

Around 3 to 5 percent of all enterprises and roughly 20 percent of large companies in Europe were using AI-based workflow automation by late 2024 (Eurostat, 2025). A growing trend is the AI agents to break complex tasks into sub-tasks, plan the execution of these sub-tasks, and achieve the overall goal by iteration and validation (see Khan, U.A. (2025)). Deloitte expects that 25 percent of AI-using companies will deploy such agents in 2025, increasing to 50 percent by 2027 (Deloitte, 2024).

Other AI technologies gaining traction include speech recognition and computer vision. These are used in applications such as voice assistants, transcription and text-to-speech, inspection report creation through voice interfaces, automated image tagging, information retrieval from videos, and intelligent surveillance. In 2024, about 4.8 percent of European enterprises were using speech recognition, and around 3 percent employed image recognition systems. Only about 1 percent had adopted autonomous robots or vehicles, indicating these remain niche areas (Eurostat, 2025).

Emerging Trend: AI Agents

AI systems that break down complex tasks, plan execution, and achieve goals through iteration.

AI companies deploying agents by 2025

25 %

Expected adoption by 2027

50 %

Challenges in Adopting AI at Scale

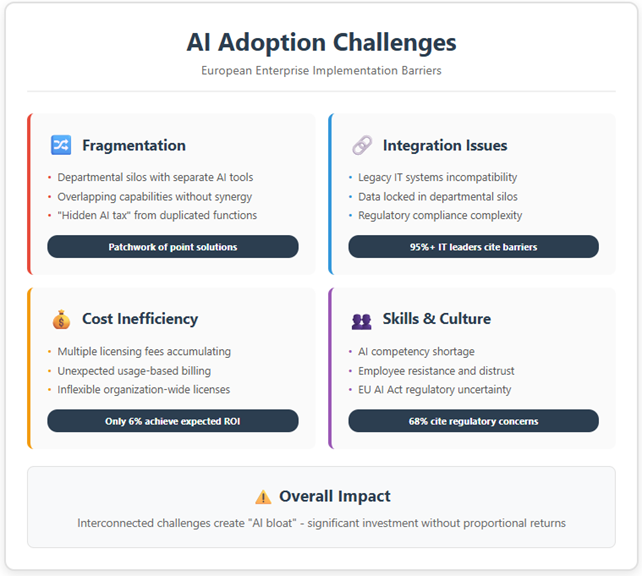

While AI promises significant benefits, European enterprises are encountering a range of challenges in implementing AI at scale. Many companies are still learning how to integrate AI effectively into their existing systems and workflows. One major issue is the fragmentation of AI tools within organizations. In these early days of enterprise AI, it’s common for different departments to independently adopt their own AI or analytics solutions without a unified strategy.

This can lead to a patchwork of point solutions. Many of these applications have overlapping capabilities, but because they were adopted in silos, the company is not benefitting from any synergy between them. This fragmented approach has been called the “hidden AI tax”, as mentioned by Glean (2025), which refers to the extra costs and inefficiencies that accumulate when companies layer multiple unintegrated AI tools on top of each other.

Closely related to fragmentation are integration issues and data silos. Most AI systems need to connect with a company’s data sources and software infrastructure to be effective. If every department’s AI tool is separate, integrating them to get a unified view is difficult. Data may remain locked in departmental databases and not shared across the organization. European companies often cite legacy IT systems and inconsistent data formats as obstacles when trying to deploy AI.

The AI algorithms might be powerful, but connecting them to existing business processes is a non-trivial task. Additionally, strict data protection regulations mean companies must be very careful about how data is used and shared by AI systems, which sometimes slows down integration across silos.

Another challenge is the cost and efficiency issue of managing multiple AI solutions. Many AI tools, especially enterprise-grade ones, may have licensing or subscription costs. If a company is licensing several different AI platforms, the expenses add up quickly. Unlike some traditional software, AI tools often charge based on usage or require a cloud infrastructure, which can surprise companies with high bills.

There are also costs for training employees on each tool and for maintaining them. Another issue is inflexible licensing models, for example, some vendors require an organization-wide license even if only one department needs the AI feature, or demand a high minimum number of users. A company might have to pay for a generative AI feature in a collaboration app for all employees, even if only a handful actually use it. In essence, organizations risk paying for AI tools that overlap in functionality or remain underutilized, which is an inefficient allocation of resources.

This contributes to “AI bloat”, as mentioned by Glean (2025), which refers to spending a lot on many AI initiatives without a proportional business return. Indeed, despite growing investment in AI, many companies have yet to see the payoff.

Beyond technology and cost, organizational and skill challenges also play a role. Adopting AI at scale requires new skills and ways of working, which many European companies are still developing. There is a shortage of AI competencies in many organizations. This skills gap makes it hard to progress beyond pilot projects, as companies may rely heavily on external consultants or vendors for AI expertise.

Moreover, internal resistance or cultural hurdles can slow adoption: employees might be unsure how to use AI tools or even distrust them, especially if not adequately trained. There are also governance and ethical concerns. Uncertainty around the EU AI Act is cited by about 68% of businesses as a factor making them hesitant or unclear about how far to push AI initiatives (AWS, 2025). Companies want to avoid legal risks, so some take a cautious approach, which can be a barrier to fast adoption.

Scaling Beyond Early AI Adoption

AI adoption in Europe’s enterprise sector is advancing quickly but unevenly. The year 2025 finds many European companies at a turning point: a growing number have dipped their toes into AI projects, yet relatively few have fully scaled AI’s use across their operations. Key data show a steady progress in adoption rates and spending, indicating that businesses recognize AI’s potential. At the same time, challenges surrounding fragmented tools, integration issues, costs, and skills have meant that capturing AI’s value has been slower and more complex than the initial hype suggested.

The opportunity for European enterprises is to turn early AI experiments into sustainable, organization-wide capabilities. Trends such as centralizing AI platforms, upskilling employees, and integrating AI into everyday systems indicate a future where AI is more accessible, unified, and deeply integrated into how companies operate and compete.

If businesses can overcome current hurdles by breaking down data silos, managing costs, and promoting a culture of AI literacy and innovation, they stand to unlock significant productivity gains and new growth avenues. In a competitive global landscape, adopting AI responsibly and strategically will be key for European companies to improve services, make smarter decisions, and ultimately drive better business outcomes.

Contact

Dr. Umair Ali Khan

Senior Researcher

+358 29 447 1413

umairali.khan@haaga-helia.fi

References

Amazon Web Services (AWS). (2025). Unlocking Europe’s AI Potential 2025 (Press release summary). AboutAmazon.eu – Innovation News. https://www.aboutamazon.eu/news/innovation/ai-adoption-outpaces-early-mobile-phone-uptake (Accessed 14 June 2025)

Deloitte. (2024). Now decides next: Is Europe ready for generative AI? Deloitte Insights. https://www2.deloitte.com/insights/generative-ai-in-europe.html (Accessed 14 June 2025).

Eurostat. (2025). Use of artificial intelligence in enterprises (Data extracted January 2025). European Commission, Statistics Explained. https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Use_of_artificial_intelligence_in_enterprises (Accessed 14 June 2025).

Glean. (2025). The State of AI at Work in 2025: Centralized platforms vs. the AI tax (White paper). Glean Company. https://www.glean.com/resources/guides/glean-state-of-ai-2025 (Accessed 14 June 2025).

McKinsey & Company. (2024). The state of AI: 2024 global survey results. McKinsey Digital Insights. https://www.mckinsey.com/quantumblack/the-state-of-ai (Accessed 14 June 2025).

Khan, U. A. (2025). AI agents in business: A practical overview. Finnish AI Region. https://www.fairedih.fi/en/2025/05/08/ai-agents-in-business-a-practical-overview/ (Accessed 14 June 2025)

Finnish AI Region

2022-2025.

Media contacts