Finnish Startups Shatter Records with €1.5 Billion Raised in 2025

Whilst European startup funding has declined since 2022, Finnish companies are bucking the trend with over €1.5 billion raised this year — setting the stage for a record-breaking year driven by historic mega-rounds.

Text by Martti Asikainen, 25.11.2025 | Photo Adobe Stock Photos

Finland’s startup ecosystem is defying gravity. As venture capital dries up across Europe, Finnish founders are closing deals at a record pace, with two landmark rounds capturing global attention.

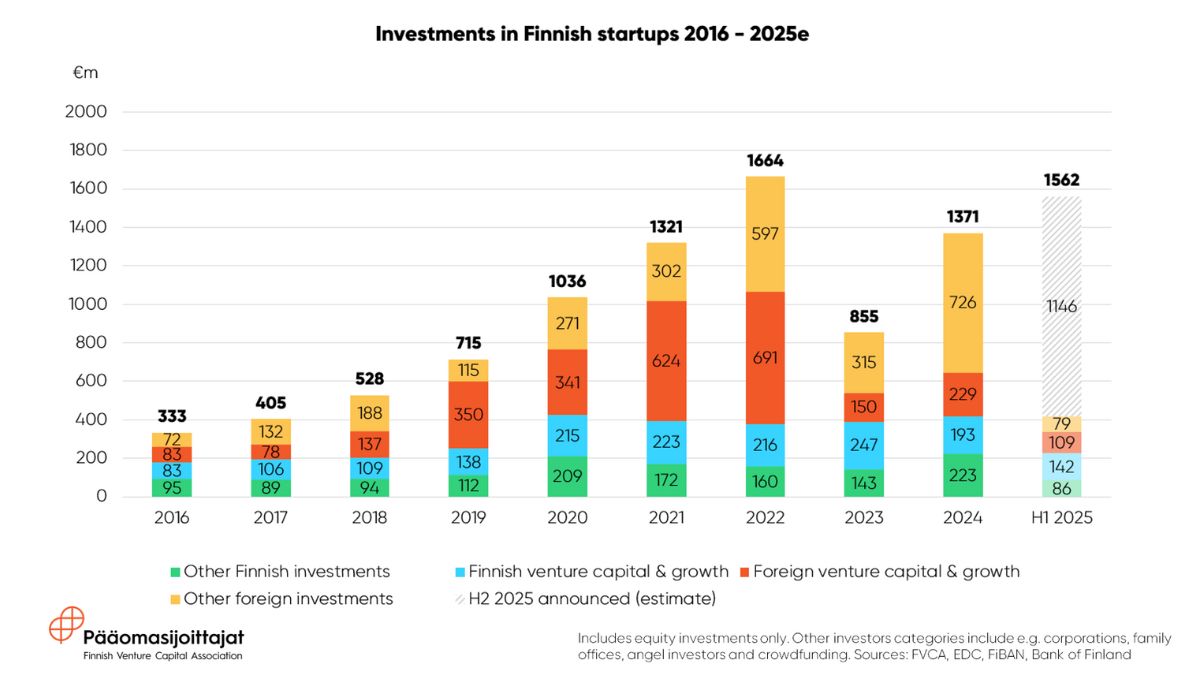

“Finnish startups have already raised more than €1.5 billion this year and are on track for a new annual record,” says Jonne Kuittinen, Deputy Chief Executive of the Finnish Venture Capital Association. “While European startup funding has been in decline since 2022, Finnish startups are going strong.”

Two Mega-Rounds Define the Year

The surge has been driven by Oura’s €777 million raise, the largest funding round in Finnish history, and quantum computing firm IQM’s €275 million round, the fifth-largest ever. Together, they’ve put Finland firmly on the global tech map.

Finnish startups raised €400 million during the first half of 2025, according to data from the Finnish Venture Capital Association. With several major autumn rounds now completed, the annual total has surpassed €1.5 billion, one of the strongest years in the nation’s tech history.

Finnish venture capital firms have committed €226 million during the first half, the second-highest half-year figure on record. Of this, €112 million went to later-stage startups, demonstrating confidence in scaling Finnish innovation.

The public sector has also stepped up significantly. Following Tesi’s new investment strategy, public-sector investments surged to €74 million in the first half, well above the typical €10–20 million range.

“Finnish venture capital funds are heavily involved in startups’ early stages, but their share tends to shrink in larger growth rounds,” Kuittinen notes. “It would be in Finland’s best interest for Finnish ownership to continue as long as possible.”

Fundraising Rebounds After Slow Start

The year wasn’t without challenges. Finnish VCs raised just €106 million in new fund capital during the first half, the second-lowest amount in recent history. Economic uncertainty has slowed exits and made fundraising difficult across Europe.

But the narrative shifted dramatically when Lifeline Ventures announced Finland’s largest-ever venture capital fund at €400 million. The fund is expected to push total annual fundraising to record levels despite challenging market conditions.

“Currently, growth in the Finnish economy can be found only in professionally owned unlisted companies,” says Riku Asikainen, Chairman of the Finnish Venture Capital Association. “This presents strong opportunities for Finnish return-seeking investors going forward.”

The timing couldn’t be better. Last week, Slush gathered thousands of founders, investors, and tech leaders in Helsinki to connect, network, and find the next investment opportunities, with Finland’s record year providing a compelling backdrop. Some announcements related to that have already been made.

Record deals, renewed public investment, and resilient domestic VCs have made 2025 a landmark year. Whilst many European ecosystems struggle, Finland has emerged as a beacon of strength, positioning itself as a leading hub for tech innovation well into 2026.

Finnish AI Region

2022-2025.

Media contacts